What Is Share of Search? Definition, Best Practices?

Have you ever wondered how many people searching online are actually looking for your brand compared to your competitors? Share of Search answers this exact question by measuring what percentage of searches in your product category are specifically for your brand. In 2025, Google processes around 9.5 million searches every minute, with over 60%

happening on mobile devices.

Tracking your brand’s Share of Search can provide valuable insights into consumer interest and predict your future market share, with some studies showing it accounts for up to 83% of it. Understanding this metric helps marketers focus their efforts on boosting brand visibility where it truly matters.

How does Share of Voice differ from Share of Search?

When comparing brand metrics, it is important to understand the difference between Share of Voice and Share of Search, as both provide amazing insights into your market presence and consumer behavior.

| Aspect | Share of Voice (SOV) | Share of Search (SOS) |

| Definition | This measures brand presence across paid and organic media channels, such as advertising, social mentions, and PR. | Measures the percentage of brand-related searches within a product category on search engines. |

| Focus | Brand visibility and media exposure across multiple channels. | Consumer search behavior and branded search interest online |

| Measurement Basis | Volume of ads, impressions, social media mentions, and overall media share. | Number of searches for the brand versus competitors in a category. |

| Reflects | Marketing spend and brand awareness efforts (input metric). | Actual consumer intent and interest (outcome metric). |

| Funnel Stage | Typically, the upper funnel shows brand awareness. | Closer to the lower funnel, indicating a stage of purchasing consideration. |

| Usage | To gauge media dominance and advertising effectiveness. | To predict market share and understand real buyer interest. |

| Data Frequency | Often periodic, based on advertising campaigns and media reports. | Continuously updated, real-time search data. |

What tools and software can measure Share of Search effectively?

Several tools can help you measure Share of Search consistently and accurately. Best practice is to use these tools regularly to capture seasonal trends and campaign effects. Some of the popular options include:

- Google Keyword Planner and Google Trends for tracking search volume.

- SEO platforms like SEMrush, Ahrefs, and Mangools allow deep keyword analysis, brand search monitoring, and competitive comparisons.

- Mangools provides a simple dashboard to compare multiple brands side by side for organic search, ideal for benchmarking.

How can Share of Search inform your SEO and content marketing strategies?

Share of Search reveals the portion of your digital audience that is looking for your brand versus your competitors, providing marketers with insight for planning effective campaigns. If your Share of Search goes up, your SEO and content efforts are likely paying off. By measuring the metrics/ changes below over time, marketing teams can see what works in creating brand presence.

- Set content priorities: Focus on terms linked to high search interest for your brand. Check out our blog on the best SEO content writing software to create optimized content that boosts your Share of Search.

- Spot gaps and opportunities: If your Share of Search lags, adjust your content topics, backlink strategy, or landing page messaging.

- Gauge real impact: Track how new blog posts, PR, or ad campaigns lift Share of Search.

What are the common pitfalls or challenges when analyzing Share of Search?

Fix the following issues by routinely updating keyword lists, cross-verifying data, and segmenting Share of Search reports. Tracking Share of Search sounds simple, but comes with a few common challenges:

- Not defining category scope: Results are only relevant if category terms are clear and competitors are accurately listed.

- Ignoring keyword variations and brand misspellings: These can skew the actual percentage.

- Overlooking seasonal spikes in interest can give a misleading picture of long-term trends.

- Relying only on one data source or looking at Share of Search in isolation from other metrics like conversion rates.

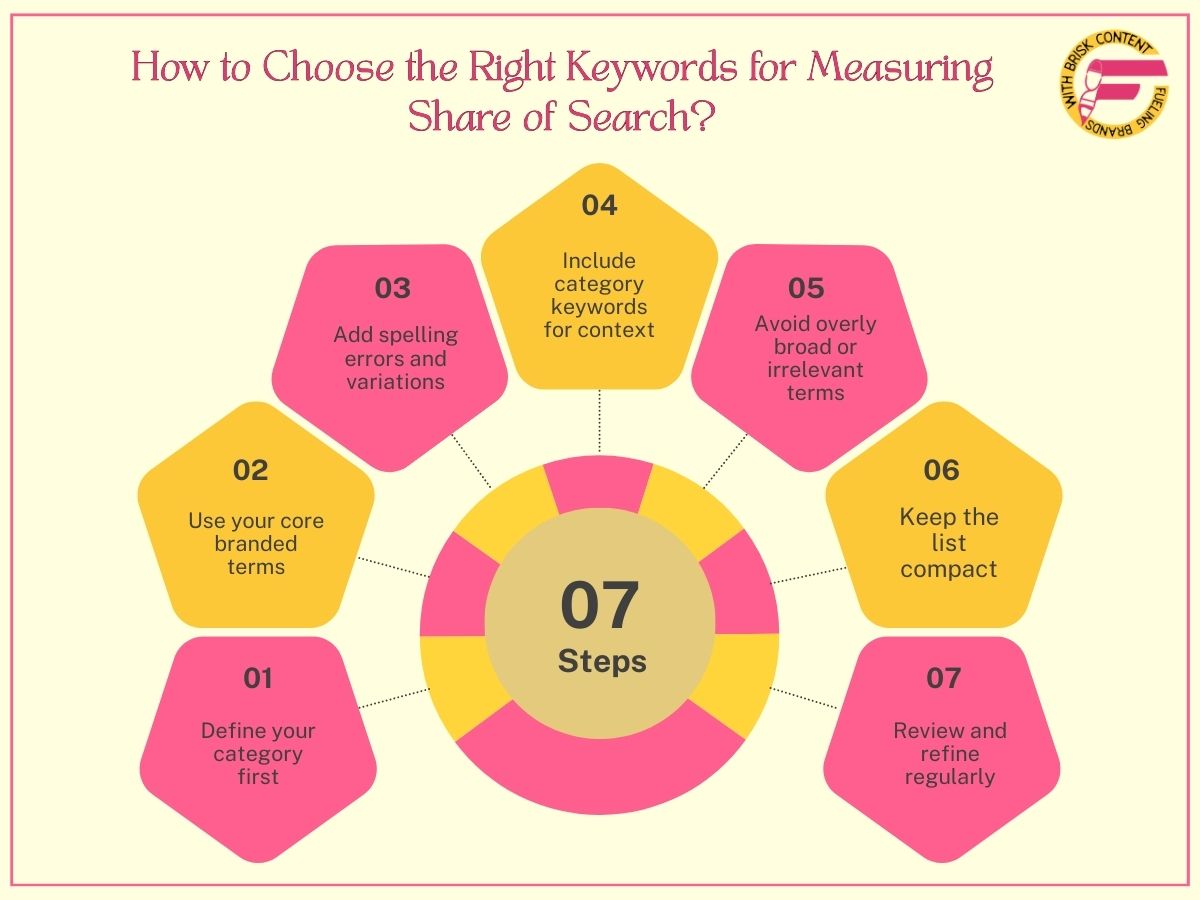

How to Choose the Right Keywords for Measuring Share of Search?

Selecting the right keywords is the foundation of accurate Share of Search analysis. A focused keyword list gives a reliable picture of consumer interest and helps you see how your brand stacks up against competitors. Here is a simple and effective way to build that list.

- Define your category first

Start by clarifying the product category you operate in. A clear category scope ensures you compare your brand against the right competitors and avoid noisy data.

- Use your core branded terms

Branded keywords should be at the centre of your list. Include your brand name, product names, and any well-known variants. These terms reveal true intent and direct brand interest.

- Add spelling errors and variations

Users often misspell brand names. Add the most common variations so you capture full search behaviour and avoid under-reporting your actual share.

- Include category keywords for context

Category terms help you understand overall search volume and validate whether interest in your market is rising or falling. Keep these terms specific and relevant.

- Avoid overly broad or irrelevant terms

Generic keywords may inflate your numbers and give a false impression of interest. Stick to terms that clearly relate to your brand or category.

- Keep the list compact

A concise keyword list reduces noise and gives cleaner trends. A small, well-selected set of terms works better than a long list filled with marginal keywords.

- Review and refine regularly

Search behaviour changes with launches, campaigns, and market shifts. Update your keyword list from time to time to keep your Share of Search data accurate. Learn more about content marketing trends shaping search in 2026 to stay ahead of keyword evolution.

How can Share of Search predict future sales or market trends?

Share of Search is often a strong leading indicator. Research suggests that shifts in Share of Search can predict up to 83% of future market share for some industries. When more people search for your brand versus the competition, it signals rising interest and intent.

This is useful for planning inventory, measuring campaign impact, or anticipating quarterly sales trends. While not guaranteed, an uptick in Share of Search usually means more people are considering your brand, often before sales numbers reflect those changes.

What industries benefit the most from tracking Share of Search?

Categories where purchase consideration starts with an online search will see the largest impact from monitoring Share of Search. Industries with high competition and frequent changes tend to gain the most, including:

- Consumer goods (e.g., beverages, snacks, electronics).

- Automotive and travel markets.

- Technology and software brands.

- Health and finance products.

How do offline marketing efforts influence online Share of Search?

Traditional ads, sponsorships, and even PR activities can impact Share of Search. Offline campaigns may generate curiosity or buzz that leads people to look up your brand online. For this reason, align your online and offline campaigns and look for jumps in Share of Search after major TV ads, events, or press coverage.

Can Share of Search be applied to social media or other digital platforms?

Share of Search has traditionally focused on search engines, but similar concepts can extend to social platforms. Tools are available for Facebook, Instagram, and YouTube to measure branded search or hashtag usage.

However, intent differs by platform. Search engines show active interest, while social media may track passive engagement or brand mentions.

How can small businesses leverage Share of Search insights compared to larger brands?

Share of Search is not just for big brands. Small businesses can use simple keyword tracking tools to see how local search interest changes and compare against nearby competitors. Smaller brands can act quickly if data shows a drop, switching up content, ads, or community engagement strategies to regain share.

You just need to focus on:

- Location-based tracking.

- Seasonal campaigns (e.g., holiday or event-driven spikes for local services).

- Niche keyword clusters that reflect your specialties.

Conclusion

Clear insights into how consumers search for your brand versus competitors open a new window of opportunity for marketers. Share of Search provides a fresh perspective on brand awareness by focusing on actual consumer purpose rather than just media presence. This clarity helps in informed decision-making in SEO, content, and marketing plans. Creating your strategy around these insights can help bridge the gap between digital visibility and real engagement.

For businesses aiming to promote their brand’s online impact and drive meaningful growth, professional content marketing can make a significant difference. Dig out how expert guidance can transform your marketing efforts by visiting Content Fayah. Let data-driven content strategies be the cornerstone of your path to capturing and retaining consumer attention in a competitive landscape.

Monthly is best, with additional checks during or after major campaigns for accuracy.

Yes, tracking search trends lets you gauge early audience interest and adjust marketing plans fast.

Not always, it can be due to seasonality, competitor launches, or temporary trends. Investigate closely before making changes.

Free options include Google Trends and Mangools’ dashboard. Paid tools offer deeper insights and reporting features.